Happy 2021, and welcome to the PB&G blog! We’ve been on our personal finance journey for a little while now, and recently thought of documenting our voyage. Hopefully you’ll be here to watch us grow! 🙂

Since it’s early in the new year, the first things we’ll share are our plans for this blog and our current portfolio!

Plans For PB&G

Our plan is to use this blog to document our personal finance journey. We’re hopefully looking to write document our investment analysis and decisions, share some guides on personal finance-related stuff (e.g. how to use IB etc. etc.) and track our net worth and portfolios! Stay tuned to watch us hopefully learn and grow 🙂

Portfolios

PB

PB’s current cash portfolio comprises SGD and USD ETFs and stocks; and some SSBs. Near the end of 2020, I sold a chunk of my ETFs to build up a small warchest. The chart below shows my portfolio tracked monthly. I’m currently trying to move more towards having most of my portfolio in my US ETF (specifically the world ETFs of previously IWDA and now VWRA), maybe about 75%, then have the remaining 25% “fun money” to play with for individual stocks, and also have a bit of warchest as well (currently ~USD 10K)! Follow my StocksCafe portfolio here 🙂

Check out the detailed portfolio:

Overall, I think I did ok-ish for 2020, not spectacularly and way worse than QQQ or the ARKs, but decent enough. I did have a couple of big-ish (40+% XIRR) winners in Fastly, AEM, Micro-Mechanics, Microsoft and Tesla. One thing I want to do for 2021 is to speculate less and also trim down my portfolio to fewer holdings so it’s easier to manage!

PG

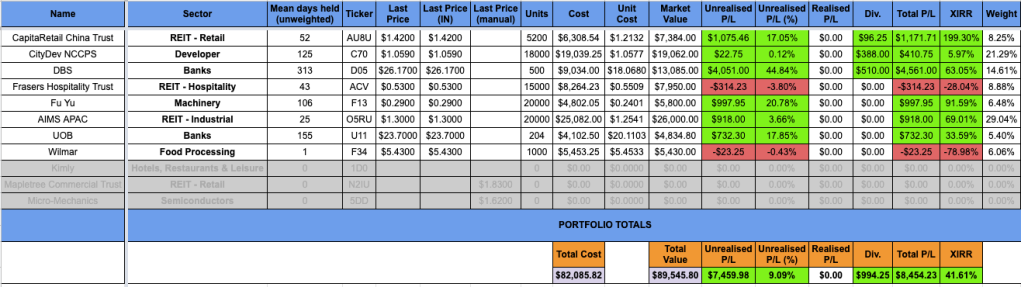

PG’s current portfolio comprises mainly stocks in the SGX market + StashAway (~15k).

In 2020, PG bought a few of the local banks shares when they dropped quite a bit. However, as PG did not want to have too much concentration risk in FIs, she started looking for stocks in other industries, such as real estate and machinery. Owing to the recovery climate , PG looked into those REITs that would provide dividend income, alongside some capital gains.

Overall, I think I could have been more active during the downturn as I didn’t expect it to end so quickly. Going forth, my plan would be to inject more growth stocks into my portfolio, as well as increase my global exposure. Of course, this won’t happen overnight. In the meantime, I will be DCA-ing into StashAway as I grow my knowledge and slowly build up my independent investment habits.